When to Edit vs Void an Invoice

As we head into the holiday shopping season your businesses will see an influx of customers looking for that perfect gift. Your sales staff will be tasked with assisting clientele and recording countless transactions. This pace will surely increase as we push even closer to the holidays. With all the holiday bustle an employee can accidentally input something incorrectly , after all “to err is human”. Once a mistake is made the question always asked is, “How do I correct it?” Luckily many things can easily be corrected without the need for voiding. If you are using BusinessMinds POS, recording transactions are quick, easy, and designed to limit user error. Of course accidents can happen, which is why invoices in BusinessMind are just as easy to modify.

BusinessMind Point of Sale interface

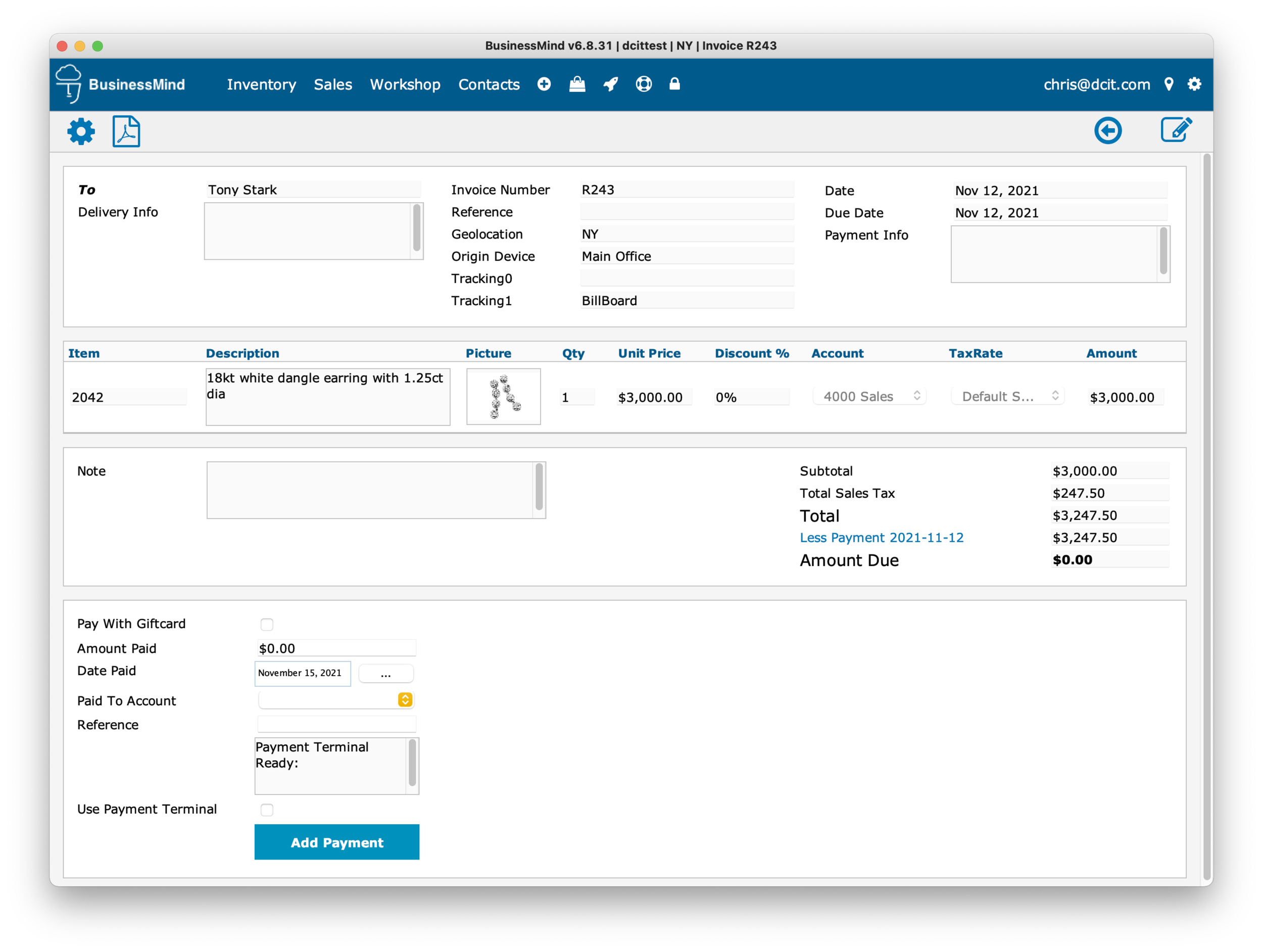

When to Edit:

The BusinessMind Invoice view allows administrative users the ability to modify an existing invoice. This can make correcting a mistake a quick and painless process without the need of voiding and recreating the entire transaction.

Information that can easily be modified from an Invoice include:

Payment Type

Payment Amount

Item Description

Date

Due Date

Reference

Tracking

Delivery Info

Notes

Sales Associates

An invoice within BusinessMind

When to Void:

The BusinessMind Invoice view allows administrative users the ability to void an existing invoice. With just one click from the original invoice you are able to generate a credit invoice which will reverse the original transaction.

Reasons to void an Invoice include:

Incorrect customer was selected for the transaction

Item price on the invoice needs modification

Incorrect tax was selected

A transaction was recorded in complete error

A credit invoice within BusinessMind

In the Works:

The ability to modify the customer on an invoice is currently in development. This feature will be available via the BusinessMind Web App in a future update.